Category: Home Loan News

-

Enhancing Global Food Security Through Disaster Risk Financing Solutions

Disaster risk financing plays a crucial role in addressing the global hunger crisis by providing financial support to vulnerable populations facing weather-related shocks and disasters. The lack of adequate risk financing tools leaves individuals and communities without the means to recover from crises, leading to heightened food insecurity. Artec Disaster Prevention Supplies | $34.83 Smallholder…

-

Coles Faces Regulatory Challenges Amid Sales Recovery and Digital Investments

Coles’ share price has experienced a significant decline in recent months, dropping over 8% from its peak in September. This downward trend can be attributed to regulatory challenges faced by the supermarket chain, particularly concerning allegations of misleading consumers with fake discounts. The Australian Competition and Consumer Commission (ACCC) took legal action against Coles and…

-

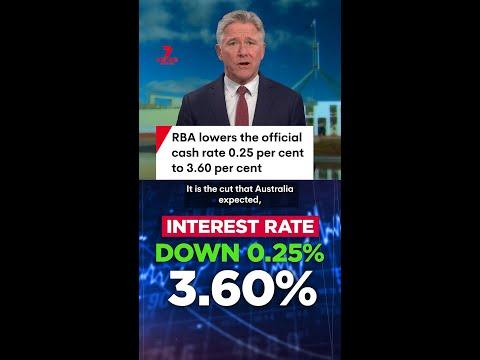

RBA Rate Hike Impact: Prepare for Mortgage Repayment Changes

The Reserve Bank of Australia has recently raised the cash rate by 0.25 percentage points, bringing it to 4.1 per cent, a level last seen in 2012. This increase is likely to impact mortgage holders with variable rate loans, potentially leading to higher monthly repayments. To understand the potential impact on your finances, you can…

-

ASIC’s Regulatory Shifts Shape Australian Financial Sector Landscape

In January 2025, the Australian financial sector witnessed significant regulatory developments that are reshaping the landscape for ASIC-regulated entities and individuals. The ASIC Annual Forum set the tone for the year, with ASIC Chair Joe Longo advocating for regulatory simplification amidst the complexities of Australia’s regulatory environment. This led to the establishment of a “Simplification…

-

Australian Banks Face Profit Challenges Amid Economic Shifts

Quarterly authorised deposit-taking institution performance statistics for Australian banks have shown a mixed bag of results. While profits fell in the December quarter due to compressed margins and reduced net interest income, overall profit levels remained historically high. Credit growth has slowed, indicating a potential challenge for bank profitability in the future as borrower demand…

-

Australian Mortgage Broking Sector Thrives with Record Loan Volumes

The mortgage broking sector in Australia is experiencing unprecedented growth, as revealed by the latest report from the Mortgage & Finance Association of Australia (MFAA) Industry Intelligence Service (IIS). The report, covering data up to September 2024, highlights record-breaking loan volumes, broker numbers, and market share. This expansion is a testament to the increasing reliance…

-

Consumer Lending Trends: Banks Prioritize Customer Relationships for Success

In a recent interview, Adam Boyd, Head of Consumer Lending at Citizens Bank, discussed the bank’s strategic transformation of its credit card offerings. The conversation delved into the motivations behind this overhaul and highlighted the significance of maintaining customer-centric strategies in a fiercely competitive market. VULKIT Slim Minimalist Card Holder RFID Blocking Leather Credit Card…