Tag: budgeting workbook

-

Coalition Warns Against Changes to Student Loan Forgiveness Programs

Last night, a coalition of 186 organizations, spanning democracy, labor, civil rights, student, and economic justice sectors, issued a stern warning to the U.S. Department of Education regarding potential changes to the student loan safety net, particularly the Public Service Loan Forgiveness (PSLF) program. Led by the Student Borrower Protection Center (SBPC) and Democracy Forward,…

-

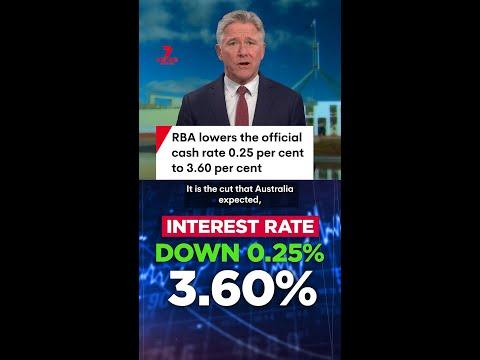

RBA Rate Hike Impact: Prepare for Mortgage Repayment Changes

The Reserve Bank of Australia has recently raised the cash rate by 0.25 percentage points, bringing it to 4.1 per cent, a level last seen in 2012. This increase is likely to impact mortgage holders with variable rate loans, potentially leading to higher monthly repayments. To understand the potential impact on your finances, you can…

-

Parliamentary Inquiry Explores Impact of Lending Regulations on Homeownership

As the Reserve Bank considers potential interest rate cuts, the focus on housing affordability intensifies in Australia. With the likelihood of rate cuts being low until early 2025, the pressure on prospective first-time home buyers is mounting. The stringent lending criteria pose significant challenges for individuals like 22-year-old Cassie McLaren, who seeks parental financial assistance…

-

Understanding Chase Credit Card Application Process for Approval Success

When applying for a credit card, the immediate approval you hope for might not materialize, leading to concerns and uncertainties about the next steps. The anxiety that follows such a scenario is common among credit card applicants. VULKIT Slim Minimalist Card Holder RFID Blocking Leather Credit Card Holder Front Pocket Wallet Magnetic Closure | $19.99…

-

Personal Loan Trends: Americans Owe $253 Billion, Delinquency Rates Drop

Personal loans have become increasingly popular in recent years, with the latest industry data showing that 24.6 million Americans collectively owe $253 billion in personal loan debt. While this amount is relatively small compared to other types of debt like mortgages and credit cards, it highlights the growing trend of personal loans among consumers. Your…