Tag: interest rate tracker

-

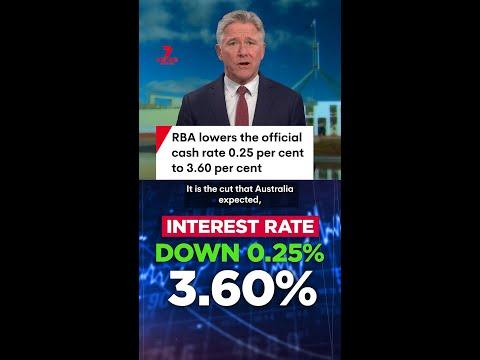

Big Four Banks Respond Swiftly to RBA Rate Cuts

Following the Reserve Bank of Australia’s decision to cut the cash rate by 0.25 percentage points at the August monetary policy meeting, Australia’s Big Four banks have swiftly reacted to the changes. The RBA’s cash rate target now stands at 3.60 per cent, prompting a series of responses from major financial institutions. ACCOUNT INTEREST RATE…

-

RBA Rate Hike Impact: Prepare for Mortgage Repayment Changes

The Reserve Bank of Australia has recently raised the cash rate by 0.25 percentage points, bringing it to 4.1 per cent, a level last seen in 2012. This increase is likely to impact mortgage holders with variable rate loans, potentially leading to higher monthly repayments. To understand the potential impact on your finances, you can…

-

Mozo Empowers Australians with Comprehensive Financial Product Comparisons

Since 2008, Mozo has been diligently tracking interest rates and product details of various providers in the Australian retail banking market. Over the years, they have expanded their database to encompass over 1,500 products across banking, insurance, superannuation, and utilities. This comprehensive comparison platform has become a trusted resource for consumers and industry professionals alike.…

-

Australian Homeowners Boost Mortgage Repayments Amid Surging Interest Rates

Australian homeowners are grappling with a significant surge in mortgage interest rates, with a nearly 20% increase reported compared to a year ago, as revealed by analysis conducted by Money.com.au. TI Financial Calculator Texas Instruments Financial Calculator, Black, IIBAPL/TBL/1L1/C | $70.55 This surge translates to an additional $4.8 billion paid to financial institutions over the…

-

RBI’s Rate Cut to Boost Real Estate Market Outlook

The Reserve Bank of India’s Monetary Policy Committee recently announced a 25 basis points cut in the repo rate to 6.25%, marking the first rate reduction in almost five years. This decision, made under the leadership of newly appointed RBI Governor Sanjay Malhotra, is expected to have significant implications, particularly in the housing sector. Artificial…

-

ANZ Leads Rate Cuts in Competitive Australian Mortgage Market

Amidst the competitive landscape of Australia’s housing market, one of the country’s major banks, ANZ, has made a bold move by slashing interest rates for new customers. This rate cut comes on the heels of similar actions by other big players in the industry, signaling a fierce battle for market share. TI Financial Calculator Texas…

-

Australian Banks Cut Home Loan Rates After RBA’s Decision

Australia’s major banks swiftly reacted to the Reserve Bank of Australia’s decision to reduce interest rates, marking the first rate cut in four years. The “big four” banks – CBA, NAB, Westpac, and ANZ – promptly announced their rate adjustments following the RBA’s public announcement on Tuesday. HP 10BII+ Financial Calculator, Black | $83.86 NAB…

-

Major Australian Banks Adjust Home Loan Rates Ahead of RBA Decision

Several major Australian lenders have recently adjusted their home loan rates in anticipation of the Reserve Bank of Australia’s (RBA) upcoming decision. The RBA’s monetary policy board is set to meet to determine the cash rate, with expectations leaning towards a 25 basis point cut. This potential rate adjustment follows a string of economic indicators,…

-

Home Loan Repayment Discrepancy Widens in Australia

Recent data analysis has uncovered a significant discrepancy in home loan repayments among various lenders in Australia. The current gap stands at $2000 per month and is projected to widen further. According to findings by Finder, while many lenders have passed on rate cuts to borrowers after the Reserve Bank of Australia’s adjustments earlier this…

-

RBA Rate Cuts Spark Optimism and Concern in Housing Market

As the Reserve Bank of Australia takes steps to ease monetary policy, interest rates are on a downward trajectory. This move has sparked optimism among potential home buyers, with mortgage pre-approvals showing an increase. Anticipation of further rate cuts in the near future has led some economists to predict a potential surge in house prices,…